A seller’s trick brings a teachable moment.

VICTORVILLE, CA–Wesley was the owner of this house in Victorville, between Los Angeles and Las Vegas.

When he contracted to sell the house to Maria, an escrow was opened to handle the transaction.

The escrow company asked Wesley to fill out an “Information Request” form, giving contact information for Wesley’s mortgage lender. Wesley completed the form, reporting two deeds of trust against the property. The first deed of trust was held by EMC Mortgage Corporation, for which Wesley provided an address, phone number, and loan number.

Escrow contacted EMC and, within a week, got a payoff demand for $176,317 good through the end of the month.

Escrow paid the demand and the transaction closed.

Ten months later Maria and her mortgage lender got notices of default, saying an unknown deed of trust was delinquent and had entered foreclosure. Someone called the title insurer.

It turned out Wesley had pulled a fast one. The information he provided about the EMC deed of trust pertained to different property, also owned by Wesley, across town. So escrow’s payment to EMC made the ‘other’ property free and clear. One month after close of escrow, Wesley and his wife refinanced the other property giving a new deed of trust for $150,000.

Having pocketed sale proceeds of $122,000, plus new loan proceeds of $150,000, Wesley netted about $270,000.

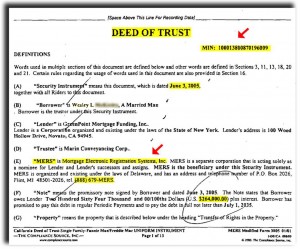

The deed of trust that Wesley left behind, the one that should have been paid off, had a principal amount of $264,000.

The title insurer demanded that Wesley straighten things out, but he wouldn’t, so the insurer paid $293,647 to clear Maria’s title.

And here’s the teachable moment: The deed of trust that was “left behind” identified “MERS,” Mortgage Electronic Registration Systems, as “nominee” for the lender during the life of the loan. MERS is a corporation formed by mortgage lenders to track ownership of promissory notes secured by mortgages and deeds of trust. Once a mortgage has been recorded in county land records, and registered with MERS, anyone wanting payoff information need only contact MERS for referral to the current loan servicer. The information is free, easy to get, and guaranteed accurate.

If escrow had asked MERS, rather than Wesley, they would have gotten true information instead of a nasty loss.