Enduring rights of parties in possession.

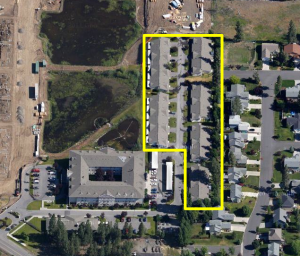

SPOKANE, WA–Clare House is a senior living community on the south side of Spokane. It has a 124-unit apartment complex, flanked by 28 “bungalow” units built in clusters much like attached homes.

The bungalows have been offered under a “Resident Agreement,” by which the buyer pays a lump sum at move-in for the right to occupy their bungalow and use common areas until they die or become unable to care for themselves. When occupancy ends, the resident or their heirs are entitled to repayment of 80 or 85% of the initial lump sum or, in some cases, 80 or 85% of the price received from resale of the bungalow. Each resident is also a member of the Clare House Bungalow Homes Residents Association, an association formed to represent their common interests.

The bungalows occupy a 2.68 acre parcel of land, which continues to be owned by the developer. Beginning in 2004, the developer took a series of loans from “hard money” lenders, secured by deeds of trust against the 2.68 acre parcel. The first of these loans was arranged by the Caudill Group, in the amount of $400,000, secured by a deed of trust in favor of the Caudill Living Trust. There were four subsequent loans, secured by deeds of trust totalling $565,000.

All of these deeds of trust were recorded in Spokane County land records. Prior to the first deed of trust, two of the Resident Agreements had been recorded, even though the bungalow residents did not have proper deeds conveying ownership of the real property.

All was well at Clare House until the developer filed bankruptcy. Then things got dicey. The lenders, headed by the Caudill Group, made known their wishes to foreclose against the 2.68 acre parcel, and oust the residents.

The Residents Association stepped in, and filed an adversary proceeding in the developer’s bankruptcy. The Association asked for a court order that the residents’ rights are superior to rights of the lenders.

The bankruptcy court ruled for the residents, in part. The court ordered that all members of the Residents Association (i.e., all those having a Resident Agreement with the developer) may continue to occupy their bungalows undisturbed by the lenders, even if the lenders foreclose and acquire the land. However, the court also held the residents’ rights to repayment upon termination of occupancy are contractual rights against the developer only, and are not enforceable against any lender.

Aerial view of the Clare House community, with apartment complex, lower left, and 2.68 acre parcel, highlighted

Citing “longstanding common law,” the court explained that one who acquires an interest in real property with actual or constructive notice of the rights of another takes subject to the other’s rights. In modern times, this rule has been refined by statute and case decisions so as to impose a duty on a subsequent purchaser (or encumbrancer) to inquire as to rights of parties in possession of land, “and a failure to inquire results in the new title holder taking title subject to whatever rights of occupancy existed.”

In this case, the court said a “casual observer” could see the bungalows were occupied as “single family residential units,” and inquiry would have disclosed the Resident Agreements. Likewise, these lenders who received financial information from the developer should have been aware of his “basic business model.” The court noted that two Residents Agreements were recorded in the land records, but this does not appear to have been decisive in the court’s reasoning.

So the residents win what amounts to a life estate in their bungalows, but must stand in line as unsecured creditors in the bankruptcy to recover what they can of promised repayments. For their part, the lenders can foreclose, but their security interests are subject to all Resident Agreements made with the developer–even those signed after deeds of trust were recorded.

Moral: Lessons here for everyone, since both residents and lenders now have much, much less than they bargained for.

The case is In re Clare House Bungalow Homes, L.L.C. (Clare House Bungalow Homes Residents Association v. Clare House Bungalow Homes, L.L.C.), 447 B.R. 617 (Bankr.E.D.Wash. 2011).