It comes to this: Is the deed void, or merely voidable?

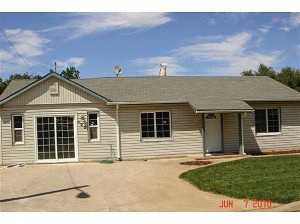

LOS ANGELES, CA–Back in the day this two unit income property in South Los Angeles was owned by David and Florence Sims. The couple lived next door.

David and Florence did some estate planning and, in September 1991, they created the Sims Family Trust to hold title to their residence and income property. With the trust agreement, the Simses directed that upon their deaths the residence would be gifted to Florence’s daughter, Shirley, and the income property would go to David’s daughter, Yvonne.

David died and, as alleged in court filings, shortly after his death Florence began to show signs of dementia. She was then 86. As her condition deteriorated, Florence came to rely on her granddaughter, Sheron, to help her with medical decisions.

By December 2001, Florence was diagnosed with paranoia, hallucinations, and dementia. She signed a Power of Attorney giving Sheron authority over her health care decisions.

Florence died April 7, 2003.

Later, in November 2003, there were recorded two grant deeds purportedly signed by Florence conveying the residence and income property to Sheron. The deeds were dated and notarized as of January 2, 2002.

Sheron proceeded to refinance the properties, taking subsantial cash “out.” The income property was last refinanced in 2006, when Sheron gave Washington Mutual a deed of trust for $440,000.

By early 2008 Sheron was in default on her loans, and in April 2008 foreclosure notices were posted on both properties.

By this time David’s daughter, Yvonne, and her husband James had opened separate probates for the estates of David and Florence. They were in possession of the properties, and were surprised by the foreclosure notices. Apparently, Sheron had made payments without anyone knowing, until she ran out of money.

Yvonne and James filed complaints to invalidate the newly-discovered deeds of trust. As to the income property, they claimed the Washington Mutual deed of trust is invalid because (a) Sheron may have forged Florence’s signature on the deed giving the property to Sheron, (b) if Florence did in fact sign the deed, she lacked mental capacity to understand what she was doing, and/or (c) if Florence did sign, she lacked capacity to understand the nature and effect of the deed.

Washington Mutual (now known as J.P. Morgan) defended the deed of trust arguing the lender relied on the Florence-to-Sheron deed in good faith and, therefore, it is entitled to favored status as a bona fide encumbrancer.

The trial court ruled in favor of the lender, and dismissed the complaint. The court reasoned the deed may be voidable, but it could not be void because, at the time its loan was made, the deed appeared in county land records and the lender had no reason to question it. Plaintiffs Yvonne and James appealed.

The Court of Appeal reversed, holding the deed would be void if any of the three grounds alleged by plaintiffs can be proven. “Generally,” the Court explained, “a deed is void if the grantor’s signature is forged or if the grantor is unaware of the nature of what he or she is signing. A voidable deed, on the other hand, is one where the grantor is aware of what he or she is executing, but has been induced to do so through fraudulent misrepresentations.”

And, said the Court, a deed which is “wholly void” cannot ordinarily provide a foundation for good title even in the hands of a bona fide purchaser or encumbrancer.

With that, the case was remanded for trial of plaintiffs’ allegations.

Moral: This decision will not be published in the official reports, because it’s based on established law, but it shows how land records are viewed (void vs. voidable) in a deed contest.

The outcome here will likely turn on medical opinion and testimony of those around Florence in her final years.

The risk of forgery or a void instrument in the chain of title is commonly covered by title insurance.

The (unpublished) case is reported as Casonhua v. Washington Mutual Bank, 2010 WL 4193214 (Cal. App. 2 Dist.).